Tax brackets 2020 calculator

Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone. Easily calculate your tax rate to make smart financial decisions.

Paycheck Calculator Take Home Pay Calculator

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

. Virginias income tax brackets were last changed thirteen years prior to 2020 for tax year 2007 and the tax rates have not been changed since at. 1 online tax filing solution for self-employed. Self-Employed defined as a return with a Schedule CC-EZ tax form.

The income brackets though are adjusted slightly for inflation. This page has the latest Virginia brackets and tax rates plus a Virginia income tax calculator. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

Both Ohios tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018. 2022 Income Tax Brackets Taxes Due April 2023. The New York income tax has eight tax brackets with a maximum marginal income tax of 882 as of 2022.

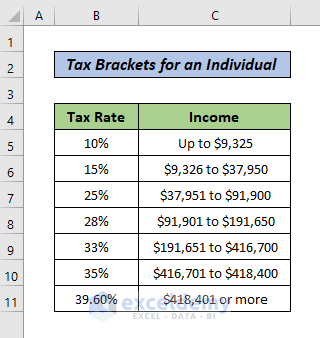

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. 10 12 22 24 32 35 and 37. This page provides detail of the Federal Tax Tables for 2020 has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state.

We do our best to ensure that all of our tax rates are kept up to date - but if you. For married taxpayers filing jointly they can use these new tax brackets to figure out how much tax they can expect to pay this coming tax season. As of 2016 there are a total of seven tax brackets.

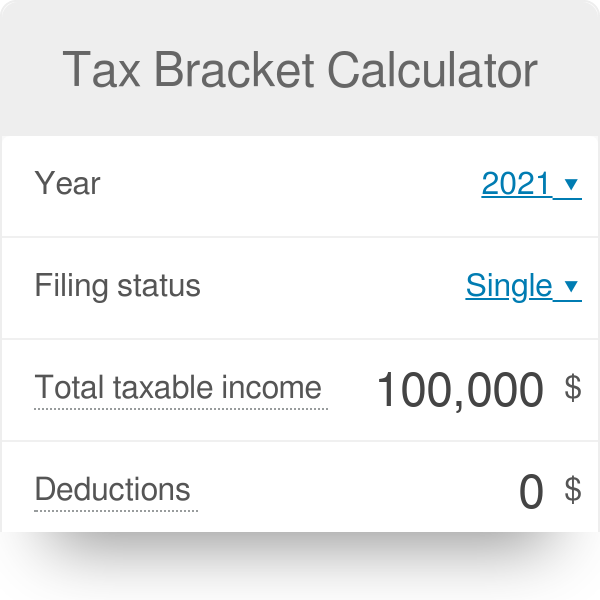

For example if you earned 100000 and claim 15000 in deductions then your taxable income is 85000. Your tax bracket depends on your taxable income and your filing status. Income tax tables and other tax information is sourced from the Alabama Department of Revenue.

Testimonials are based on TurboTax Online reviews from tax year 2020 as. Both Arizonas tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023.

In Arizona different tax brackets are applicable to. This page has the latest California brackets and tax rates plus a California income tax calculator. Note - State tax brackets for tax year 2020 due April 2021 are now available.

2020 September 18 Illinois income tax calculator. Income taxes paid Québec These are Québec. Bentle K Berlin J and Yoder C.

Testimonials are based on TurboTax Online reviews from tax year 2020. Find out your tax refund or taxes owed plus federal and provincial tax rates. Here are the tax brackets for tax years 2021 and 2022 and how you can work out which tax bracket you fit into.

Income tax tables and other tax information is sourced from the Virginia Department of Taxation. Pritzkers proposed graduated income tax affect you. 1993 saw a tax hike on the wealthy via two new brackets at the top and then 2001 through 2003 saw a series of tax cuts that lowered the tax brackets as follows.

Your taxable income places you in the following tax brackets. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. Use our Salary Tax Calculator to get a full breakdown of your federal and state tax burden given your annual income and.

Estimate your tax refund and where you stand Get started. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

Federal This is the amount you would have paid as income tax see the tax brackets below for reference. The IRS recently announced the new tax brackets for the 2021 tax year to be filed in 2022. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133.

Your filing status determines which set of tax brackets are used to determine your income tax. The new 2018 tax brackets are 10 12 22 24 32 35 and 37. Arizona has four marginal tax brackets ranging from 259 the lowest Arizona tax bracket to 45 the highest Arizona tax bracket.

10 of the amount over 0. Many states do not release their current-tax-year 2021 brackets until the beginning of the following year and the IRS releases federal tax brackets for the current year between May and December. This free tax calculator is supported by Google Consumer Surveys.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. There are seven tax brackets for most ordinary income for the 2021 tax year.

10 12 22 24 32 35 and 37. This page has the latest Alabama brackets and tax rates plus a Alabama income tax calculator. 2020 Tax Brackets and Tax Rates for filing in 2021 Single.

All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. 2022 CWB amounts are based on 2021 amounts indexed for inflation.

Ohio has five marginal tax brackets ranging from 285 the lowest Ohio tax bracket to 48 the highest Ohio. Californias income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2013. You can use our free New York income tax calculator to get a good estimate of what your tax liability will be come April.

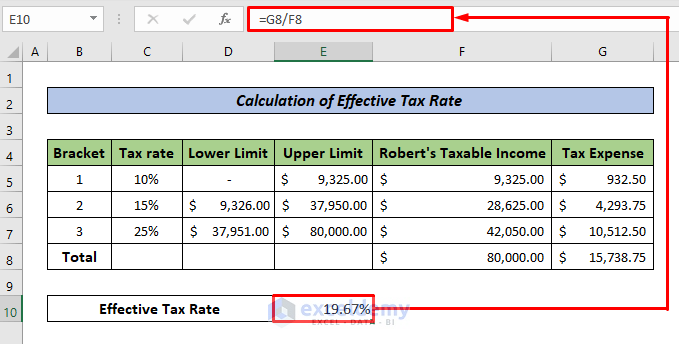

That 85000 happens to fall into the first four of the seven tax brackets meaning that portions of it are taxed at different rates. Americas 1 tax preparation provider. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

If taxable income is over. On the next page you will be able to add more details like itemized deductions tax credits capital gains and. TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes.

Federal tax bracket. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Income tax tables and other tax information is sourced from the California Franchise Tax Board.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. These are the tax rates for married couples filing jointly. Your taxable income is the amount used to determine which tax brackets you fall into.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors. Alabamas income tax brackets were last changed twelve years prior to 2020 for tax year 2008 and the tax rates have not been changed since at least 2001.

Ohios tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. The Arkansas income tax has four tax brackets with a maximum marginal income tax of 660 as of 2022. See this Tax Calculator for more.

You can use our free Arkansas income tax calculator to get a good estimate of what your tax liability will be come April. See chart at left. Answer a simple question or complete an alternate activity to dismiss the survey.

How To Calculate Federal Income Tax

Federal Tax Calculator Flash Sales 55 Off Www Wtashows Com

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Inkwiry Federal Income Tax Brackets

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Income Tax Calculator 2020 Store 50 Off Www Wtashows Com

Tax Bracket Calculator

How To Calculate Federal Tax Rate In Excel With Easy Steps

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Tax Calculator Flash Sales 55 Off Www Wtashows Com

Tax Calculator 2020 Discount 57 Off Www Wtashows Com

Effective Tax Rate Formula Calculator Excel Template

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Federal Tax Rate In Excel With Easy Steps

Tax Calculator For Salary Deals 57 Off Www Wtashows Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Calculator 2020 Discount 57 Off Www Wtashows Com